In many countries, credit cards are known for giving users access to instant credit — allowing purchases now and paying later. But in Myanmar, the concept works a little differently. If you’ve ever used a UAB Bank, AYA Bank, or other local credit card, you may have noticed something unusual: you need to pre-top-up your card before spending. But why is that? Let’s explore.

🔍 What Are Credit Cards in Myanmar?

In Myanmar, most so-called “credit cards” issued by local banks are prepaid or secured credit cards. These cards don’t offer a credit line in the traditional sense. Instead, you deposit money into your card account — and then you can spend up to that amount.

So, if you top up 500,000 MMK, your “credit limit” is 500,000 MMK.

💳 Why Pre-Top-Up is Required

Here are the key reasons why Myanmar’s credit cards need pre-top-up:

1. 🏦 Limited Credit Infrastructure

Myanmar’s financial system is still developing. Most banks avoid offering unsecured credit due to risk and regulatory challenges. Requiring pre-top-up helps control that risk and encourages responsible spending.

2. 🔐 Security for Banks

With prepaid or secured models, banks protect themselves from loss. There’s no chance of someone borrowing money and defaulting — because the money is already there.

3. 🌍 International Transactions Support

Pre-top-up credit cards (often Visa or MasterCard) are used for international payments, especially for:

- Booking flights

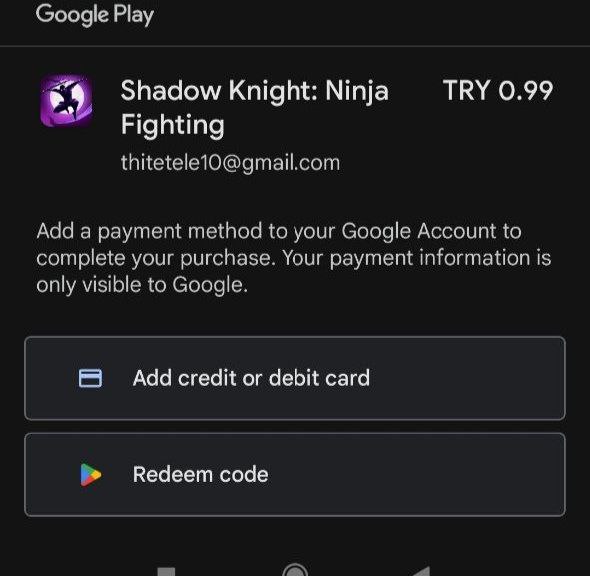

- Paying for online services (e.g. Netflix, Namecheap, Facebook Ads)

- Shopping on Amazon or Alibaba

Banks like AYA and UAB require you to preload USD or MMK equivalent before enabling international purchases.

4. 📉 No Credit History System Yet

Unlike Western countries, Myanmar doesn’t yet have a full credit scoring system. So banks can’t evaluate your creditworthiness properly. A pre-top-up system makes sense in the absence of such infrastructure.

🏦 Examples of Credit Cards in Myanmar

✅ AYA Credit Card

- Top-up via AYA Mobile Banking

- Used for international websites

- Must convert MMK to USD inside app

✅ UAB Credit Card

- Supports Visa card with online use

- Top-up required before every use

- Secure and easy for controlled spending

🤔 Is It Really a Credit Card?

Technically, these are closer to prepaid debit cards with Visa/MasterCard capabilities, but many banks market them as “credit cards” for simplicity.

You don’t get to “borrow” money from the bank — you’re simply spending what you already loaded.

👍 Benefits of Pre-Top-Up Cards in Myanmar

- Safe for budgeting – no debt surprises

- Good for students and freelancers

- Accepted internationally

- Secure and trackable via mobile banking

🚧 Limitations to Know

- No real credit or borrowing option

- Manual top-up needed every time

- Not ideal for emergency expenses

🔚 Conclusion

definitely it’s weird because it’s The Myanmar